ING digitalizes asset distribution with Market

ING and Komgo partnered to enhance the Market solution, expanding its capabilities to include asset distribution. Already adopted by several banks, the solution went live in June 2024 after months of dynamic collaboration. Nataša Kovač (VP, FI Portfolio Management and Distribution) and Galyna Kozak (VP, FI Portfolio Management and Distribution) discussed with our Product Manager, Izabela Czepirska, how ING benefits from Market and how it has improved their daily operations.

A Solution by the Market, for the Market

ING, one of Europe’s largest financial institutions, serves corporate clients and financial institutions across more than 35 countries. Regularly awarded for their innovation and service quality, the bank has been a pioneer in asset distribution, making ING a natural partner for Komgo on this journey.

Having started distributing trade-related assets nearly two decades ago, ING has seen many software-led attempts to digitalize trade asset distribution fail; this time it’s different.

“What sets this initiative apart is that the early adopters' group consists of market participants themselves. It was a collective effort where everyone’s wishes and pain points were considered to create a solution that works for the broader market.

It’s a solution by the market, for the market.”

Nataša Kovač, VP, FI Portfolio Management and Distribution

ING

Engaged in a co-innovation process, a total of 8 major banks contributed to building the solution, and the number of new users is constantly growing.

3 reasons why ING took the leap into digitalizing asset distribution

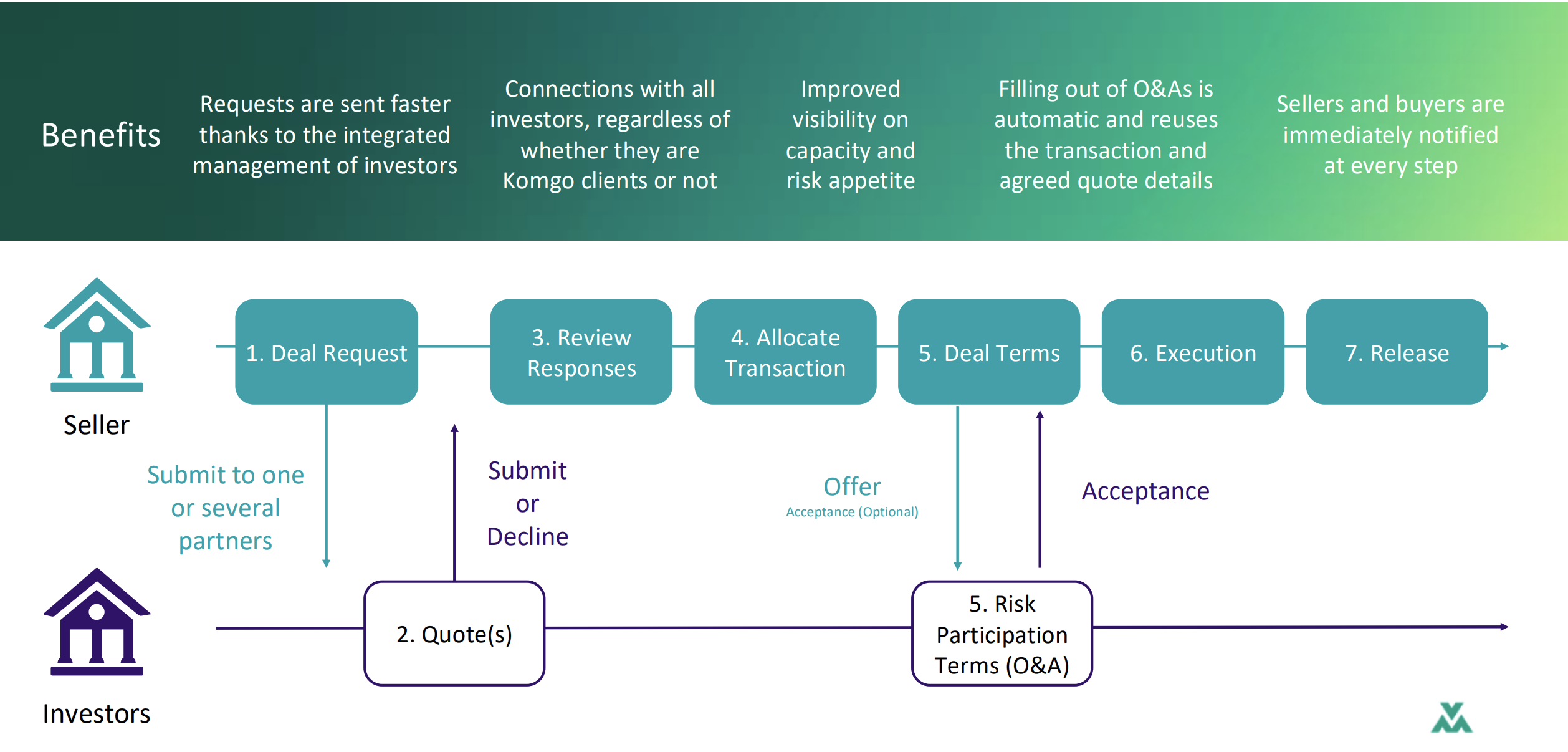

1. An open system to streamline investor feedback effortlessly

ING's ability to quickly connect the right offers with the right investors is crucial for successful transactions. Managing a large number of investors presents a significant challenge, especially when daily updates and communication are required. With around a hundred investors in their portfolio, the new solution allows ING teams to centralize all contacts, group them effectively, and easily update their preferences, reducing reliance on Excel and streamlining the entire process. The beauty of the solution is that counterparts don’t need to be Komgo clients; onboarding investors is easy and facilitated thanks to a modern user interface.

“You can execute faster if you are putting the transaction on Komgo”

Galyna Kozak, VP, FI Portfolio Management and Distribution

ING

2. Removing manual interventions to achieve greater efficiency

As soon as investors are identified, the process consists of multiple tasks that require meticulous attention to detail, where even a small error can slow down the entire process. The solution is used for capacity allocation and becomes the negotiation platform where each piece of information is reused by the templating module to automate the filling of documents necessary for the transaction, such as the O&A. The benefits are obvious. In addition to a faster and more efficient process, it also opens the door to new ways of working.

“Once O&A templates are set up, it’s done, where the old process required systematic copy pasting and make a new one, it’s less prompt to mistakes.”

Nataša Kovač, VP, FI Portfolio Management and Distribution

ING

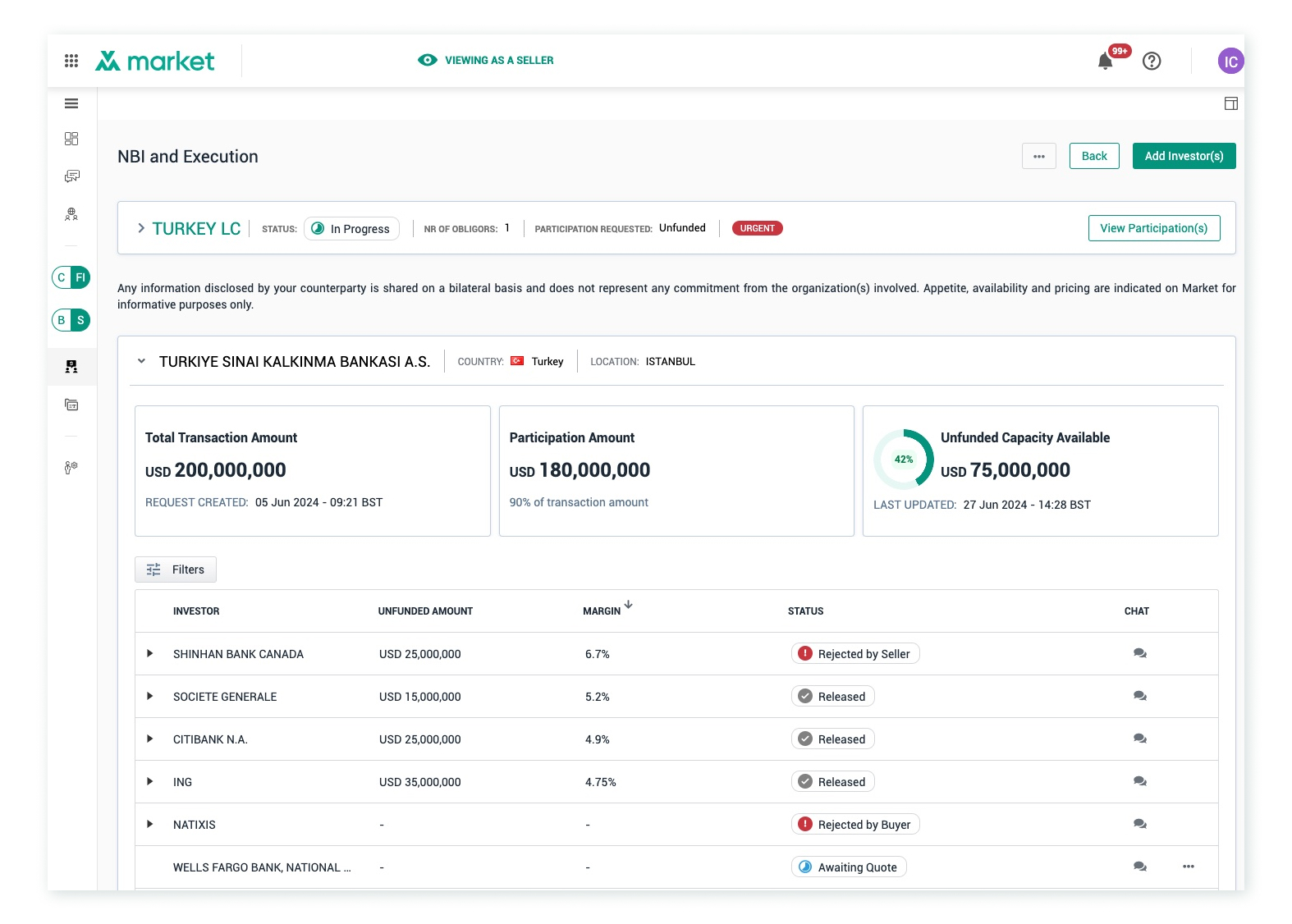

3. Unlocking the power of data

The benefits extend beyond process efficiency. The solution becomes significantly more powerful when used systematically, as it offers advanced analytical capabilities that were previously unattainable. It is now easier to respond to inquiries from other departments about potential capacity and to conduct historical data analyses. ING can access crucial information, such as the number of offers sent, the responses received, and the accuracy of proposed offers compared to the investor’s appetite, which previously would have taken days to compile. This enables more informed discussions with counterparts.

“We have a nice overview which we did not have before, who responded, who did not, what are the quotes—all in one very nice screen. Before you had to dig your emails and try to make notes somewhere of whether you found enough capacity for the deal, chase people... Now you can do it more efficiently.”

Galyna Kozak, VP, FI Portfolio Management and Distribution

ING